Shopping cart

Your cart empty!

Terms of use dolor sit amet consectetur, adipisicing elit. Recusandae provident ullam aperiam quo ad non corrupti sit vel quam repellat ipsa quod sed, repellendus adipisci, ducimus ea modi odio assumenda.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Do you agree to our terms? Sign up

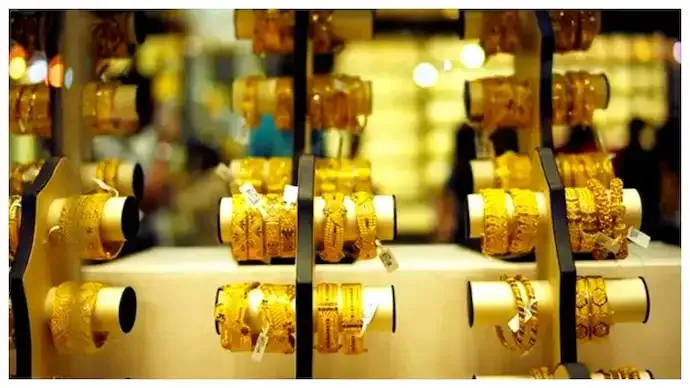

Gold prices retreated from record peaks on Thursday, with both 22-carat and 24-carat gold witnessing declines. Analysts attribute the pullback to a combination of a firmer US dollar, cautious trading ahead of upcoming economic data, and persistent geopolitical tensions.

1. Stronger US Dollar Pressures Gold

A primary factor behind the decline was the appreciation of the US dollar, which rose about 0.6% this week. Since gold is priced in dollars, a stronger greenback makes it more expensive for buyers using other currencies. Rising US Treasury yields also added downward pressure on the precious metal.

2. Fed Signals Keep Markets Cautious

Traders exercised caution following remarks from Federal Reserve Chair Jerome Powell, who refrained from signaling the timing of future interest rate cuts. Powell emphasized the need to balance inflation risks with signs of a slowing labor market.

Despite uncertainty, markets still anticipate two modest rate cuts later this year — one in October and another in December, according to the CME FedWatch tool. Historically, lower interest rates favor gold, as the metal does not yield interest but gains appeal when borrowing costs fall.

3. Focus Shifts to Key US Economic Data

Investor attention now turns to US economic indicators due later this week. Jobless claims data on Thursday and the Personal Consumption Expenditures (PCE) index on Friday, the Fed’s preferred inflation gauge, are expected to influence expectations for interest rate movements.

Geopolitical developments also remain a factor. Ukraine reported striking two oil pumping stations in Russia’s Volgograd region overnight, keeping tensions elevated. Such developments typically enhance the appeal of safe-haven assets like gold.

In summary, the recent dip highlights gold’s sensitivity to currency fluctuations, interest rate expectations, and geopolitical risks. While prices eased from record highs, market participants remain alert to US economic updates and global events that could quickly shift momentum.

8

Published: Sep 25, 2025