Shopping cart

Your cart empty!

Terms of use dolor sit amet consectetur, adipisicing elit. Recusandae provident ullam aperiam quo ad non corrupti sit vel quam repellat ipsa quod sed, repellendus adipisci, ducimus ea modi odio assumenda.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Do you agree to our terms? Sign up

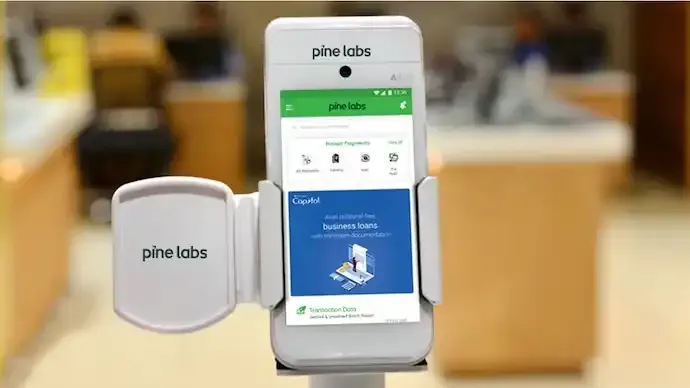

Pine Labs’ strong market debut continued to fuel investor optimism on Friday, with the stock extending gains after listing at a premium. Shares of the fintech company opened at ₹242 on the BSE—9.5% higher than the IPO price—and climbed further to ₹283.70, marking a 28.5% jump. By 12:33 pm, the stock was trading at ₹257.35, valuing the firm at nearly ₹29,557 crore.

The ₹3,900 crore IPO, which remained open between November 7 and 11, was subscribed close to 2.5 times. Demand was primarily driven by institutional investors, with the QIB segment being subscribed 4 times. The employee quota witnessed heavy oversubscription at 7.7 times, indicating strong internal confidence. Retail and NII participation was comparatively subdued, a pattern seen in several IPOs this year.

The public issue comprised a fresh issue of ₹2,080 crore and an offer for sale worth ₹1,819.91 crore. Allotments were finalised on November 12, ahead of the November 14 market debut.

Market analysts maintain a cautiously optimistic view.

Prashanth Tapse, Senior Vice President (Research), Mehta Equities, said Pine Labs’ listing surpassed expectations despite its higher valuation. He recommended long-term investors hold on to the stock, while new investors may wait for consolidation before entering. According to him, Pine Labs’ position in merchant payments, high-margin software contributions, and its expanding footprint in India and Southeast Asia support sustained growth.

Shivani Nyati, Head of Wealth at Swastika Investmart, said the 9.5% listing premium reflects strong sentiment surrounding the company’s merchant commerce platform and diversified revenue model. She advised investors to book partial profits while maintaining a stop-loss at ₹200 for the remaining holdings. Nyati pointed out that while Pine Labs’ long-term potential remains strong, competition in fintech and regulatory developments should be monitored.

31

Published: Nov 14, 2025