Shopping cart

Your cart empty!

Terms of use dolor sit amet consectetur, adipisicing elit. Recusandae provident ullam aperiam quo ad non corrupti sit vel quam repellat ipsa quod sed, repellendus adipisci, ducimus ea modi odio assumenda.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Do you agree to our terms? Sign up

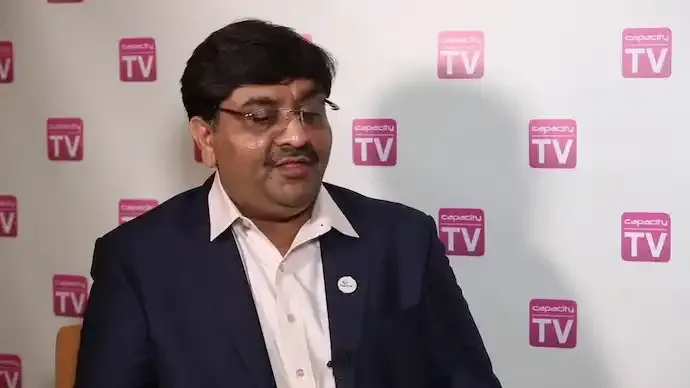

A major financial controversy has emerged in the United States as Indian-origin telecom entrepreneur Bankim Brahmbhatt faces serious allegations of a $500 million loan fraud. The accusations come from HPS Investment Partners, a BlackRock-backed investment firm, which claims that Brahmbhatt inflated revenues and faked customer accounts to secure massive loans.

According to The Wall Street Journal (WSJ), Brahmbhatt, who owns Broadband Telecom and Bridgevoice, allegedly pledged non-existent receivables and fake customer contracts to secure loans from multiple American lenders. These loans, financed partly by BNP Paribas in partnership with HPS, ballooned from $385 million in 2021 to $430 million by August 2024.

The WSJ report states that lenders have now filed lawsuits accusing Brahmbhatt of misleading them with falsified revenue data. His companies are currently undergoing Chapter 11 bankruptcy proceedings, collectively owing over half a billion dollars.

On August 12, 2025, Brahmbhatt filed for personal bankruptcy, the same day his firms sought protection under Chapter 11. When reporters visited his New York office in Garden City, it was found locked and deserted. Neighbors reported no activity at the site for weeks, raising suspicions that the entrepreneur may have fled to India — a claim his legal team denies.

The scandal has sent shockwaves through the private credit sector, which has been expanding rapidly as investors seek high-yield returns outside traditional banking systems. Experts have warned that such markets, which often rely on projected revenues as collateral, are increasingly vulnerable to fraud.

This case echoes other financial collapses, such as First Brands and Tricolor Auto Group, where firms allegedly misused asset-based loans before declaring bankruptcy. Analysts believe the Brahmbhatt fraud case could prompt tighter scrutiny and regulatory oversight across the global private credit landscape.

The case highlights the growing risks of private lending in the absence of robust auditing and due diligence mechanisms. With top institutions like BlackRock indirectly linked through HPS, questions are now being raised about investor protection and systemic transparency in alternative financing models.

While the investigation continues, Brahmbhatt’s legal representatives maintain that the accusations are unfounded and exaggerated. Authorities in the US are reportedly working with international agencies to determine the entrepreneur’s whereabouts and trace the missing funds.

The Bankim Brahmbhatt fraud case serves as a cautionary tale for investors and regulators navigating the high-stakes world of private credit. As legal proceedings unfold, the case may shape future compliance standards for billion-dollar lending operations worldwide.

8

Published: 13h ago