Shopping cart

Your cart empty!

Terms of use dolor sit amet consectetur, adipisicing elit. Recusandae provident ullam aperiam quo ad non corrupti sit vel quam repellat ipsa quod sed, repellendus adipisci, ducimus ea modi odio assumenda.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Do you agree to our terms? Sign up

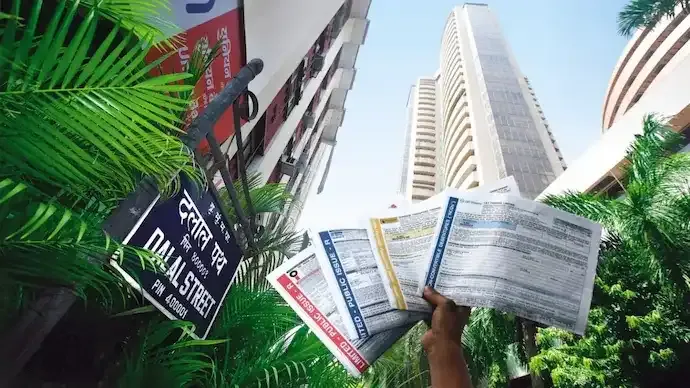

Benchmark indices Sensex and Nifty opened flat on Tuesday as Indian markets consolidated ahead of a busy day of Q2 corporate earnings.

At 9:33 am, the S&P BSE Sensex was down 123.01 points at 83,855.48, while the NSE Nifty50 fell 53.50 points to 25,710.05.

The cautious start reflects investor restraint amid foreign institutional investor (FII) selling, muted IT earnings, and anticipation of key quarterly results.

Dr. VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said that renewed FII selling is capping market momentum.

“During the last four days, FIIs have sold equities worth ₹14,269 crore. This suggests they will continue to sell on rallies.

Higher valuations in India and muted earnings growth are restraining FIIs who are eyeing cheaper markets with stronger growth,” he noted.

He added that while this could be a short-term challenge, India’s medium-term outlook remains positive given strong GDP growth and stable domestic inflows.

Top Gainers:

Bharti Airtel (+2.54%)

Titan (+0.83%)

Reliance Industries (+0.22%)

Mahindra & Mahindra (+0.13%)

Kotak Mahindra Bank (+0.04%)

Top Losers:

Power Grid Corporation (-2.48%)

Tech Mahindra (-1.21%)

HCL Technologies (-1.09%)

Maruti Suzuki (-0.86%)

Eternal (-1.38%)

The early trade pattern suggests selective buying in telecom and consumer stocks, offset by weakness in IT and auto counters.

Nifty Midcap 100: +0.06%

Nifty Smallcap 100: -0.16%

India VIX: +1.69% (indicating mild volatility)

Sectoral highlights:

Nifty Media (+0.53%), Nifty Realty (+0.25%), Nifty Consumer Durables (+0.32%) led early gains.

Nifty Auto (-0.70%), Nifty IT (-0.43%), and Nifty FMCG (-0.50%) dragged the index lower.

PSU banking stocks remained resilient, supported by strong valuations and upcoming consolidation plans.

According to Vijayakumar, despite near-term pressure from FIIs, India’s medium-term fundamentals remain strong, driven by GDP growth, corporate expansion, and fiscal stability.

“The resilience in PSU banking continues to stand out. This space remains attractively valued in an otherwise richly priced market,” he said.

“The sector’s long-term outlook is bright, especially in light of potential mergers and improving credit quality.”

He further added that FY27 could witness around 15% earnings growth, suggesting markets may start discounting this optimism soon.

With global markets mixed and FIIs cautious, domestic investors are focusing on upcoming Q2 earnings from key sectors including IT, banking, and FMCG.

Analysts expect range-bound movement in the short term, with selective buying in quality large-caps likely to support indices.

Market views and investment opinions mentioned above are those of analysts and brokerage firms. Investors are advised to consult professional advisors before making trading or investment decisions.

13

Published: Nov 04, 2025