Shopping cart

Your cart empty!

Terms of use dolor sit amet consectetur, adipisicing elit. Recusandae provident ullam aperiam quo ad non corrupti sit vel quam repellat ipsa quod sed, repellendus adipisci, ducimus ea modi odio assumenda.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Do you agree to our terms? Sign up

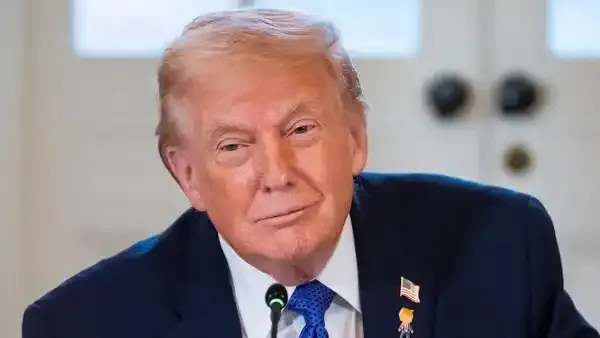

United States President Donald Trump may not be delivering on his promise to make America great again, but financial markets are delivering a different verdict — Trump is making gold stronger than ever.

Gold prices are smashing record highs with unusual momentum, defying traditional market logic. There is no global recession, inflation is largely under control in major economies, and central banks have not launched fresh stimulus. Yet bullion continues to surge, fuelled by something far harder to quantify: political uncertainty emanating from Washington.

Each new tariff threat, diplomatic standoff, or institutional confrontation linked to Trump’s second term has triggered fresh buying in safe-haven assets. Unlike past rallies driven by crisis economics, this surge reflects a deeper erosion of confidence in policy stability.

Commodity and currency analyst Aamir Makda notes that the rally is structural rather than speculative. According to him, gold and silver are rising almost daily as geopolitical risks, currency concerns, and central bank diversification accelerate. Central banks across emerging and developed markets are steadily reducing exposure to the US dollar, reinforcing gold’s long-term demand.

Since Trump’s return to office, markets have been forced to repeatedly reprice risk. His renewed tariff campaign — including proposed levies on multiple European nations — has revived fears of a prolonged global trade conflict. The unpredictability of linking trade penalties to geopolitical demands has further unsettled investors.

Market strategist Jateen Trivedi explains that domestic currency weakness has amplified the rally in India, one of the world’s largest gold markets. As the rupee remains under pressure, gold prices have found additional support, with investors treating even minor pullbacks as buying opportunities.

Trump’s confrontational approach toward institutions has also raised concerns about the independence of the Federal Reserve. Any perception of political pressure on monetary policy undermines confidence in fiat currencies — a dynamic that historically benefits precious metals.

According to Vinod Nair of Geojit Investments, global equity markets have already begun reflecting this shift. Risk appetite weakened sharply after Trump’s tariff threats against European allies, triggering capital rotation into gold and away from equities and the dollar. While some Asian markets have shown resilience, broader sentiment remains cautious.

Beyond trade, geopolitical flashpoints are compounding market anxiety. Territorial disputes, resource competition, and strained alliances have become persistent features of the investment landscape. Analysts argue that gold is no longer just a hedge against inflation — it has become a hedge against governance risk.

Amit Jain of Ashika Global Family Office Services describes the metal as “geopolitics in physical form,” noting that conflicts over strategic regions and resources instinctively drive investors toward bullion. The rally, he says, reflects a declining faith in global political stability rather than short-term speculation.

In India, the impact is being felt across households and businesses. Jewellery prices have surged, gold loans have grown more expensive, and wedding-season demand is being reshaped by elevated costs. Yet despite high prices, demand remains resilient, signalling that confidence in gold is outweighing price sensitivity.

Makda believes the trend has further room to run, pointing to strong resistance levels and ambitious global targets now being discussed openly by traders. Whether or not those targets are reached, the underlying message is clear: markets are voting with capital.

Gold does not respond to slogans or campaign promises. It responds to uncertainty, inconsistency, and fear of policy shocks. In that sense, Trump’s presidency has become one of gold’s strongest tailwinds.

America’s future may remain debated, but the verdict from bullion markets is already in — instability has value, and gold is pricing it in.

49

Published: Jan 20, 2026