Shopping cart

Your cart empty!

Terms of use dolor sit amet consectetur, adipisicing elit. Recusandae provident ullam aperiam quo ad non corrupti sit vel quam repellat ipsa quod sed, repellendus adipisci, ducimus ea modi odio assumenda.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Do you agree to our terms? Sign up

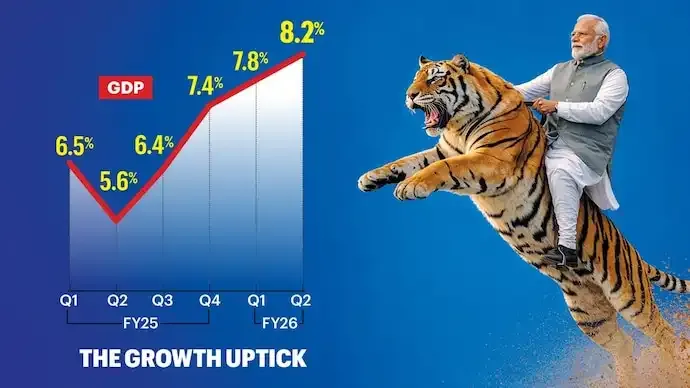

India’s economy has entered a rare high-growth, low-inflation phase, with GDP expanding 8.2 per cent in Q2 of FY26, surpassing expectations and marking the fastest quarterly growth in recent years. Combined with benign inflation, the performance has raised a critical question: can this momentum be sustained and translated into jobs, private investment and long-term expansion?

The Q2 numbers exceeded the Reserve Bank of India’s projection of 7 per cent and improved on Q1’s 7.2 per cent growth. While part of the rise reflects a low base and a modest GDP deflator, multiple structural and cyclical factors suggest the economy is entering a more robust phase.

Low inflation has been a key driver. Consumer prices have remained within the lower end of the RBI’s 2–4 per cent target range for several months, helped by subdued food inflation and stable crude prices. Tax reforms, including GST slab rationalisation and income tax relief, have also boosted disposable incomes, setting the stage for a demand revival.

Consumption indicators strengthened sharply during the festive season, which will be reflected more clearly in Q3 data. Passenger vehicle sales rose 23 per cent during the festive window, while two-wheelers, commercial vehicles, consumer electronics and appliances also recorded strong growth. Analysts say premiumisation trends indicate rising consumer confidence after years of wage stagnation and pandemic caution.

Despite strong growth, the RBI chose to support momentum rather than restrain it. In December, it cut the repo rate by 25 basis points to 5.25 per cent, marking the fourth rate cut of 2025 and a cumulative easing of 125 basis points — the most aggressive since 2019.

Under Sanjay Malhotra, the central bank has complemented rate cuts with liquidity support through bond purchases and currency swaps. Lower borrowing costs are expected to ease EMIs for households and encourage capital expenditure by companies.

Early signs of revival are visible. Data from the Centre for Monitoring Indian Economy shows new investment proposals rising 20 per cent year-on-year in the September quarter. Capacity utilisation in manufacturing has improved, and analysts expect a gradual capex cycle in housing, logistics, consumer durables and green manufacturing.

Can the Momentum Last?

Economists broadly agree that sustaining growth will depend on careful policy calibration. While tax cuts and GST changes have boosted demand, these are largely one-time measures. Longer-term momentum will require steady job creation, private investment and supply-side reforms.

A key positive development ahead is the planned revision of India’s GDP base year from FY12 to FY23, which is expected to better capture the digital economy, formalisation and new-age services. The revision could lift headline GDP estimates, providing additional fiscal room for public spending.

Despite optimism, headwinds remain. Food inflation is structurally volatile, and a poor crop season or global crude shock could quickly reverse price stability. Transmission of rate cuts is another concern, as banks have passed on only part of the cumulative easing so far.

Fiscal pressures also persist. GST rationalisation and income tax relief could reduce government revenues by around Rs 2 lakh crore in FY26, limiting space for public investment. Externally, weak global demand, volatile capital flows and a depreciating rupee pose additional risks.

Rating agencies and brokerages have raised India’s FY26 growth forecasts to above 7 per cent, citing strong domestic demand and coordinated fiscal-monetary policy. However, economists caution that the current “Goldilocks” phase will require deft management.

Too much stimulus could reignite inflation, while premature tightening could stall recovery. Policymakers face the challenge of converting this cyclical upswing into a structural growth story through reforms, investment and fiscal discipline.

India’s economy is roaring again — but sustaining the pace will demand precision, not complacency.

78

Published: Dec 29, 2025