Shopping cart

Your cart empty!

Terms of use dolor sit amet consectetur, adipisicing elit. Recusandae provident ullam aperiam quo ad non corrupti sit vel quam repellat ipsa quod sed, repellendus adipisci, ducimus ea modi odio assumenda.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Dolor sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Sit amet consectetur adipisicing elit. Sequi, cum esse possimus officiis amet ea voluptatibus libero! Dolorum assumenda esse, deserunt ipsum ad iusto! Praesentium error nobis tenetur at, quis nostrum facere excepturi architecto totam.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Inventore, soluta alias eaque modi ipsum sint iusto fugiat vero velit rerum.

Do you agree to our terms? Sign up

China’s efforts to reduce Western dominance in advanced semiconductor manufacturing continue to intensify, but despite heavy investments and bold technological experiments, the country remains far from matching the West’s most sophisticated chip-making capabilities.

At the heart of the global technology rivalry lies silicon chip manufacturing — a sector critical not only to consumer electronics but also to artificial intelligence, military power and economic dominance. While China has poured vast resources into the sector, export controls led by the United States and its allies continue to slow Beijing’s progress.

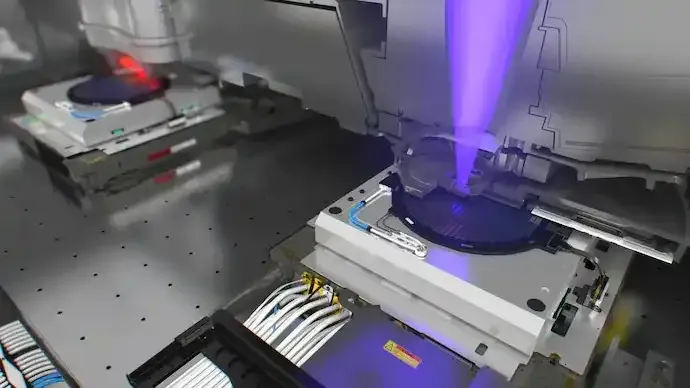

Modern digital infrastructure — from smartphones and electric vehicles to AI data centres — depends on cutting-edge chips manufactured using extremely complex processes. These chips are produced using extreme ultraviolet (EUV) lithography, a technology monopolised by a single company: ASML.

ASML is the only manufacturer globally capable of producing EUV lithography machines, which are essential for making chips at 7-nanometre nodes and below. These machines power the world’s most advanced processors used by leading tech firms and defence systems alike.

China has responded to Western restrictions with unprecedented state-backed initiatives. In recent weeks, Beijing announced a multi-billion-dollar fund aimed at accelerating “hard technology” development, with semiconductor manufacturing as a central focus.

More dramatically, reports indicate that China has reverse-engineered key components of an EUV lithography machine in a high-security laboratory in Shenzhen. The project, often described as China’s equivalent of a “Manhattan Project,” reportedly involves former ASML engineers and has produced a prototype currently undergoing testing.

Despite the scale of the effort, experts caution that replicating EUV technology is not merely about assembling machines. ASML itself took over 15 years to move from prototype to commercial production, relying on a tightly integrated ecosystem of European and American suppliers.

Unable to access EUV tools, China has focused on refining older deep ultraviolet (DUV) lithography techniques. The country’s most advanced chipmaker, SMIC, has managed to push DUV technology to impressive limits.

Recent analysis suggests that SMIC’s latest chips, used in Huawei devices, approach performance levels associated with early 5nm processes. However, industry analysts stress that these chips still lag behind those produced by leading global foundries using EUV, particularly in terms of efficiency, yield and scalability.

Without access to EUV or a comparable breakthrough, China’s chip manufacturing remains fundamentally constrained.

Semiconductor manufacturing is often described as one of the most complex industrial processes ever developed. EUV lithography operates at near-atomic scales and depends on ultra-precise optics, light sources and materials science developed over decades.

While China has proven its ability to dominate manufacturing across multiple sectors, advanced chips and commercial jet engines remain notable exceptions. Building not just the machines but the entire ecosystem required to support them is a challenge that cannot be solved overnight.

Industry leaders acknowledge that China may eventually overcome these barriers. Former ASML executives have previously noted that export controls can slow progress but not stop it entirely, as the laws of physics are universal.

However, timing is crucial. By the time China reaches EUV-level capability, Western firms may have already moved on to next-generation technologies, preserving their strategic edge.

For now, despite determined efforts and massive funding, China’s ambition to challenge Western dominance in advanced chip manufacturing remains a work in progress — and one likely to take longer than Beijing hopes.

116

Published: Dec 29, 2025